Mortgage in Germany for Expats: Your Path to Home Ownership

Buying a property in Germany as an expat can be complex. We make it simple. Get independent advice in English and access to 500+ banks.

Why many banks say "No" – and how we get you a "Yes"

Navigating the German mortgage market while holding a Blue Card or a temporary residence permit can be frustrating. Most local banks have rigid criteria for non-EU citizens.

At Flusche Finance, we specialize in financing for expats. We understand the nuances of international income, residency status, and the specific requirements of German lenders. We don’t just find a loan; we find the right partner for your specific situation

As an expat in Germany, the entire mortgage financing process can be challenging. There are significant differences depending on your country of origin.

- What types of financing are available?

- How much money can I borrow?

- Am I eligible for a mortgage?

- How much will the monthly instalment (EMI) be?

- When do I have to purchase the property at the notary’s office?

These are just a few of the many questions that arise during the entire process. We at Flusche Finance are experts in providing professional and comprehensive support in English for your real estate purchase. We have a lot of experience and know the small details to pay attention to. Don’t waste time with your purchase and let a professional guide you.

Our service is free of charge for you, as we receive a commission from the bank.

Understand the process and the most important data

As an expat, proper mortgage planning is all the more important. You must adhere strictly to the bank’s rules and are not allowed to deviate from them.

If you decide to work with Flusche Finance on your mortgage, we will start with a detailed initial consultation.During this, we will clarify exactly whether you are eligible for a mortgage or how you can work towards it.

You will learn how the EMI and the purchase price are related and what you should pay attention to when viewing a property.

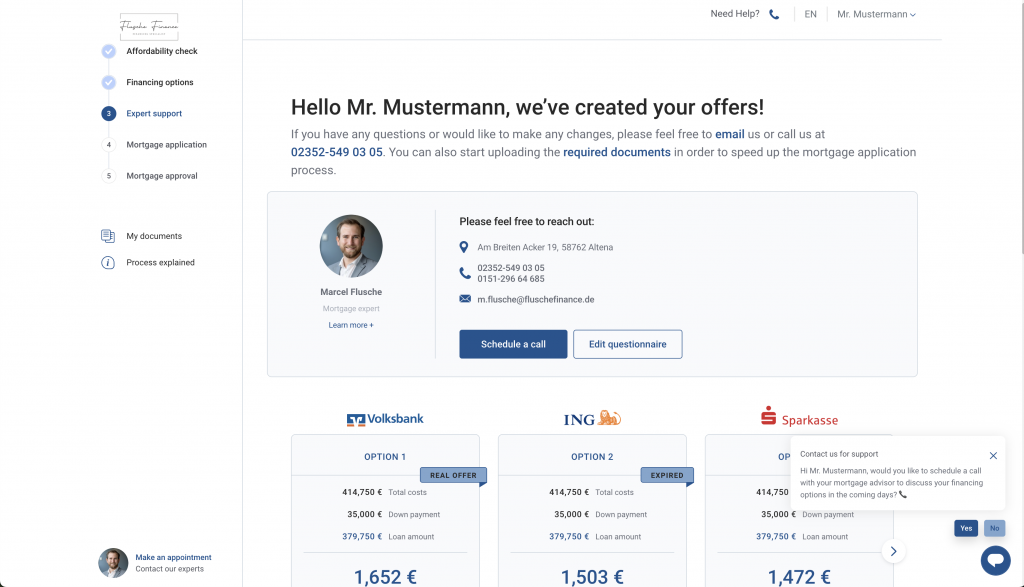

Modern digital system

Our consulting services are always digital. That’s why we put a lot into modern tech. Our customer system is 100% bilingual, and you can work on your mortgage from your end without having to worry about our working hours.

From your personal questionnaire to uploading documents, you’ll find everything in one place in our digital system.

Best service level

Since lots of questions can slow you down, we put a lot of attention to being easy to reach and giving quick responses.

You work with a personal partner who is responsible for your project. This means you don’t have to explain who you are and what it’s about every time you call.

Your Mortgage Document Checklist

- Residence Permit (Aufenthaltstitel): A valid copy of your permit (e.g., Blue Card) to verify your residency status.

- ID or Passport (Personalausweis / Reisepass): A copy of both sides of your ID. If using a passport, please include your registration certificate (Meldebescheinigung).

- Last 3 Payslips (Lohn-/Gehaltsabrechnungen): Please provide your payslips

- Equity Proof: Bank statements showing your savings for the down payment and closing costs.

- Income Tax Assessment (Einkommensteuerbescheid): The full assessment for 2024, including all explanatory pages.

- Annual Tax Statement (Lohnsteuerbescheinigung): Your annual statement for 2024(required if the final 2024 tax assessment is not yet available).

- Employment Contract (Arbeitsvertrag): A current copy of your signed employment agreement.

Client Testimonials

Plan your mortgage

You will receive customized financing solutions free of charge and without obligation.

✔ No obligation ✔ Free of charge ✔ Personal advice

FAQ: Your Questions About German Mortgages

Can I get a mortgage in Germany as a non-EU citizen or with a Blue Card?

Yes, absolutely. While many traditional banks are hesitant, we specialize in financing for expats with Blue Cards or temporary residence permits. As long as you have a stable income in Germany and a valid residency status, there are numerous lenders we can connect you with.

How much down payment (Eigenkapital) do I need?

Ideally, you should cover the closing costs (Steuern, Notar, Grundbuch) out of your own pocket. These are usually around 10–12% of the purchase price. While 100% financing is possible for some high-earners, having an additional 10–20% for the property itself will significantly improve your interest rates and increases the chances of getting the mortgage approved.

Does my credit score from my home country matter?

Generally, German banks only look at your SCHUFA (the German credit rating). They cannot access credit scores from the US, UK, or other countries. If you have recently moved to Germany, we can help you understand how to build a clean SCHUFA record quickly to qualify for a loan.

What are the current mortgage interest rates in Germany?

Interest rates fluctuate based on market conditions and your personal financial profile. Germany offers fixed-rate terms (typically 10, 15, or 20 years). By comparing over 500 banks, we ensure that you get the most competitive rate available for your specific situation.

Do I need to speak German to get a mortgage?

Not with us! We provide our consultation entirely in English. However, keep in mind that official documents like the purchase contract and notary appointments are legally required to be in German. They can be translated by a translation office, but that is not an option for every bank. We will guide you through these documents and explain every detail so you can sign with confidence.